Now, it seems not only feasible, but necessary, to call on your sacrificial giving in response to God’s grace. The capital campaign, with its life-changing elements, gives all of us working together the opportunity to be the hands and feet of Jesus in our community, especially for those who have been not so fortunate.

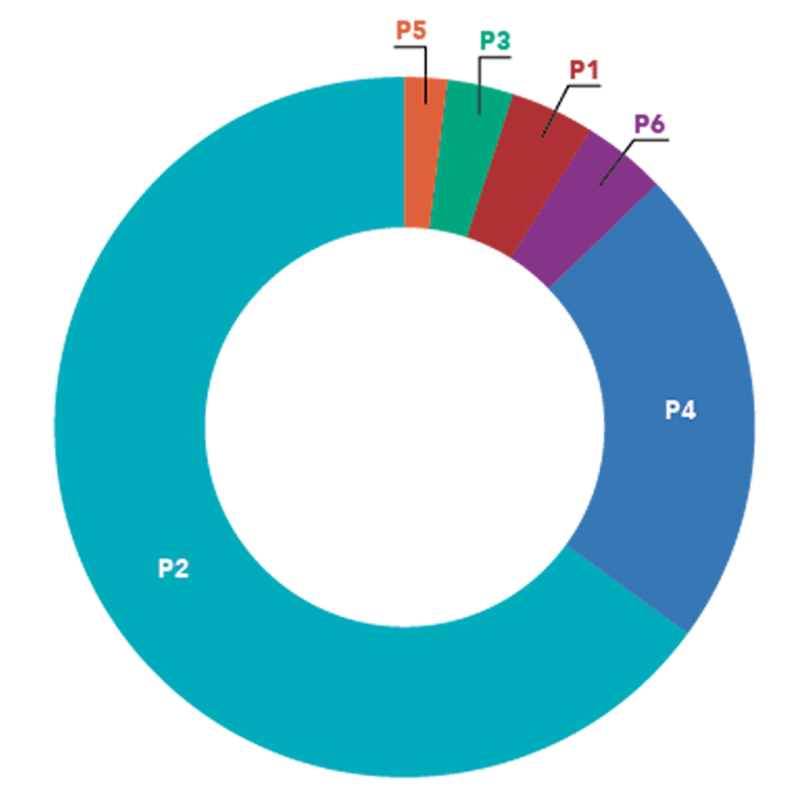

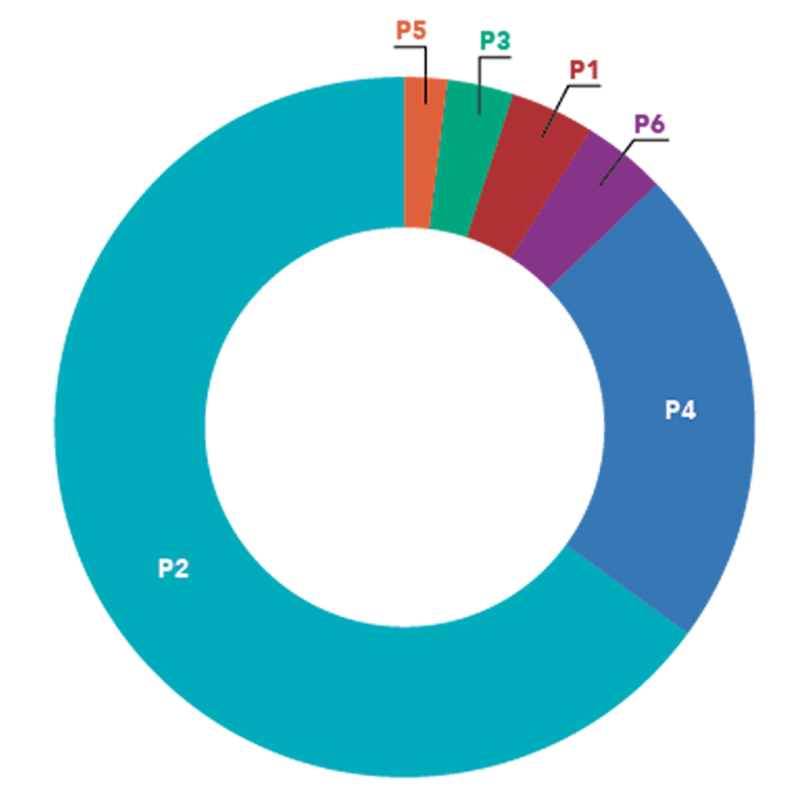

Capital Campaign Goal

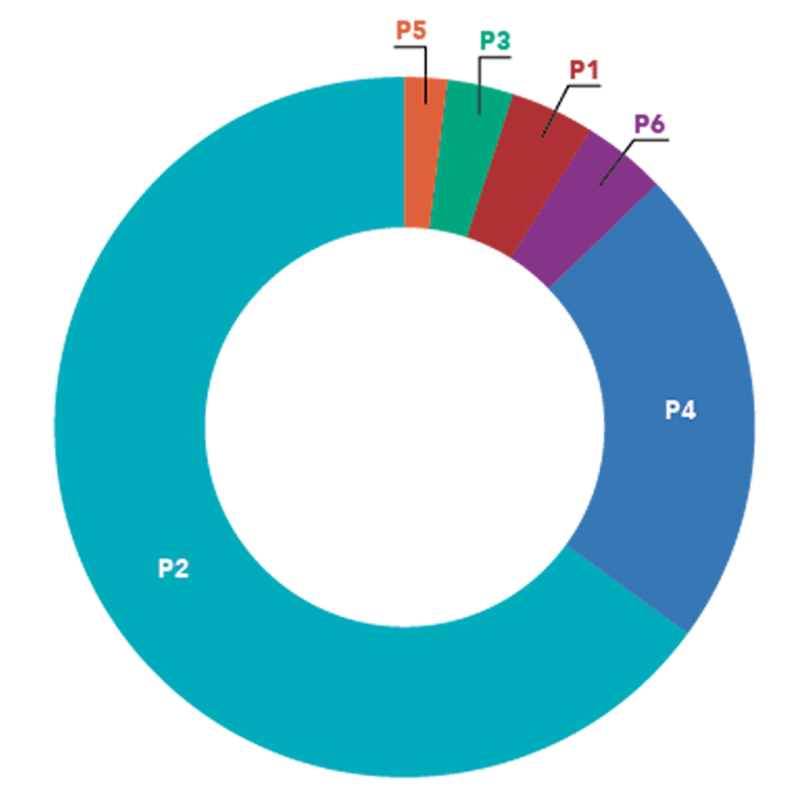

P1 – Support Small Steps

$1,000,000 | 4%

P2 – Build a Community Center

$15,000,000 | 65%

P3 – Support the PX Project Workforce Development Program

$750,000 | 3%

P4 – Retire Garage Debt

$5,000,000 | 22%

P5 – Build a New Woodshop

$800,000 | 4%

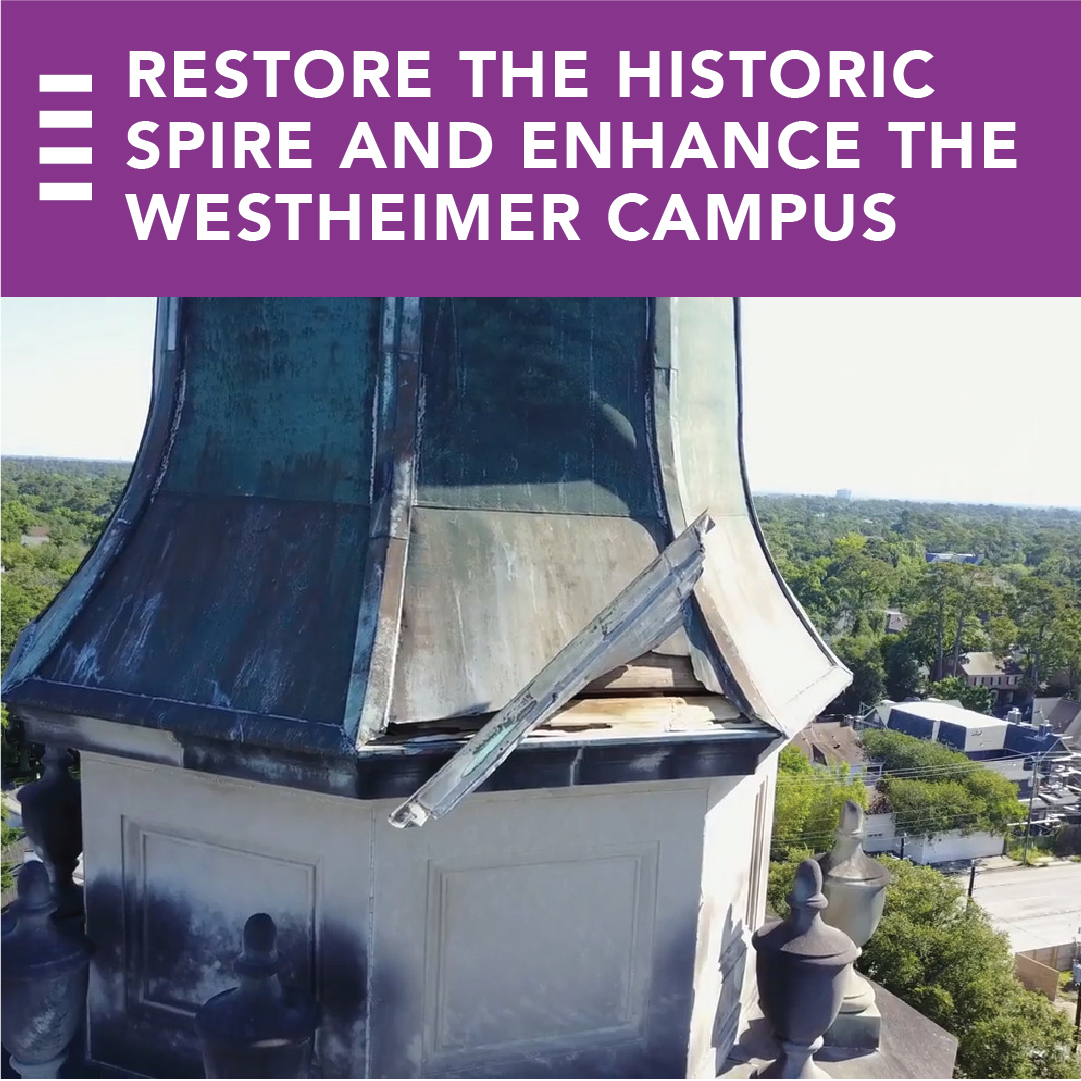

P6 – Restore the Spire, Enhance Westheimer Campus

$500,000 | 2%

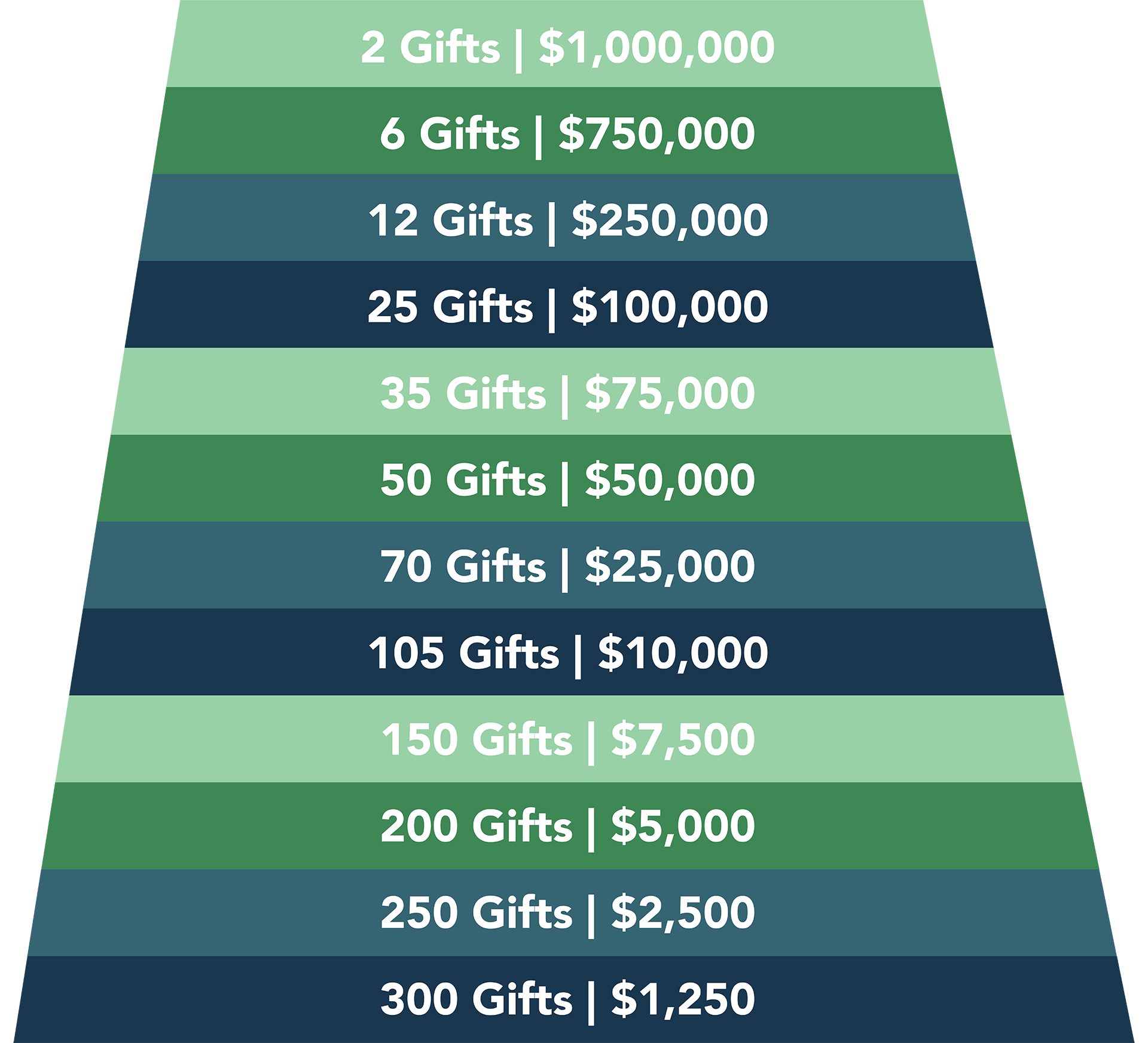

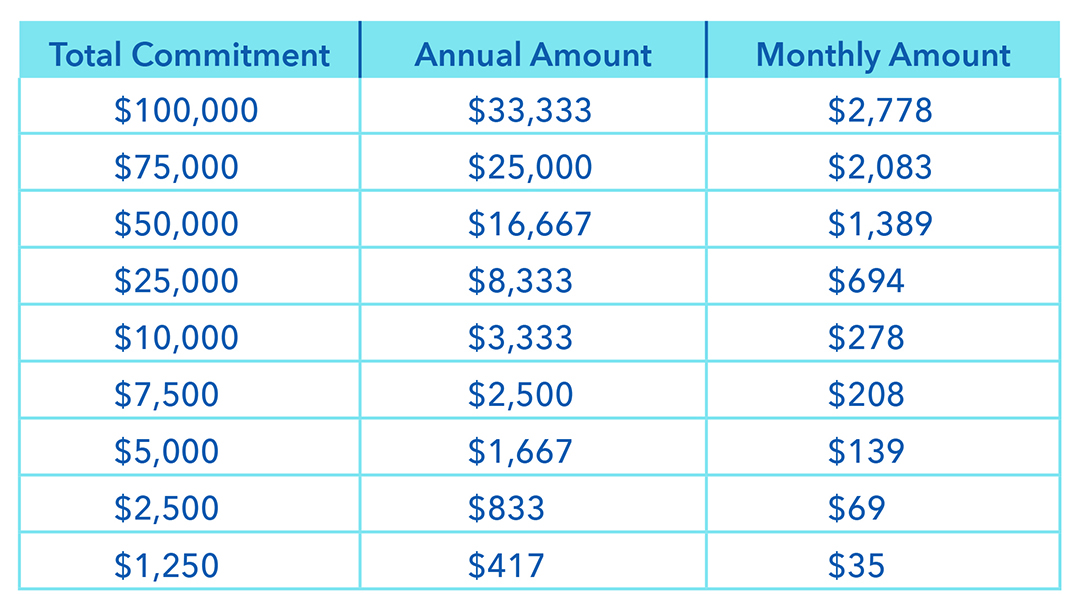

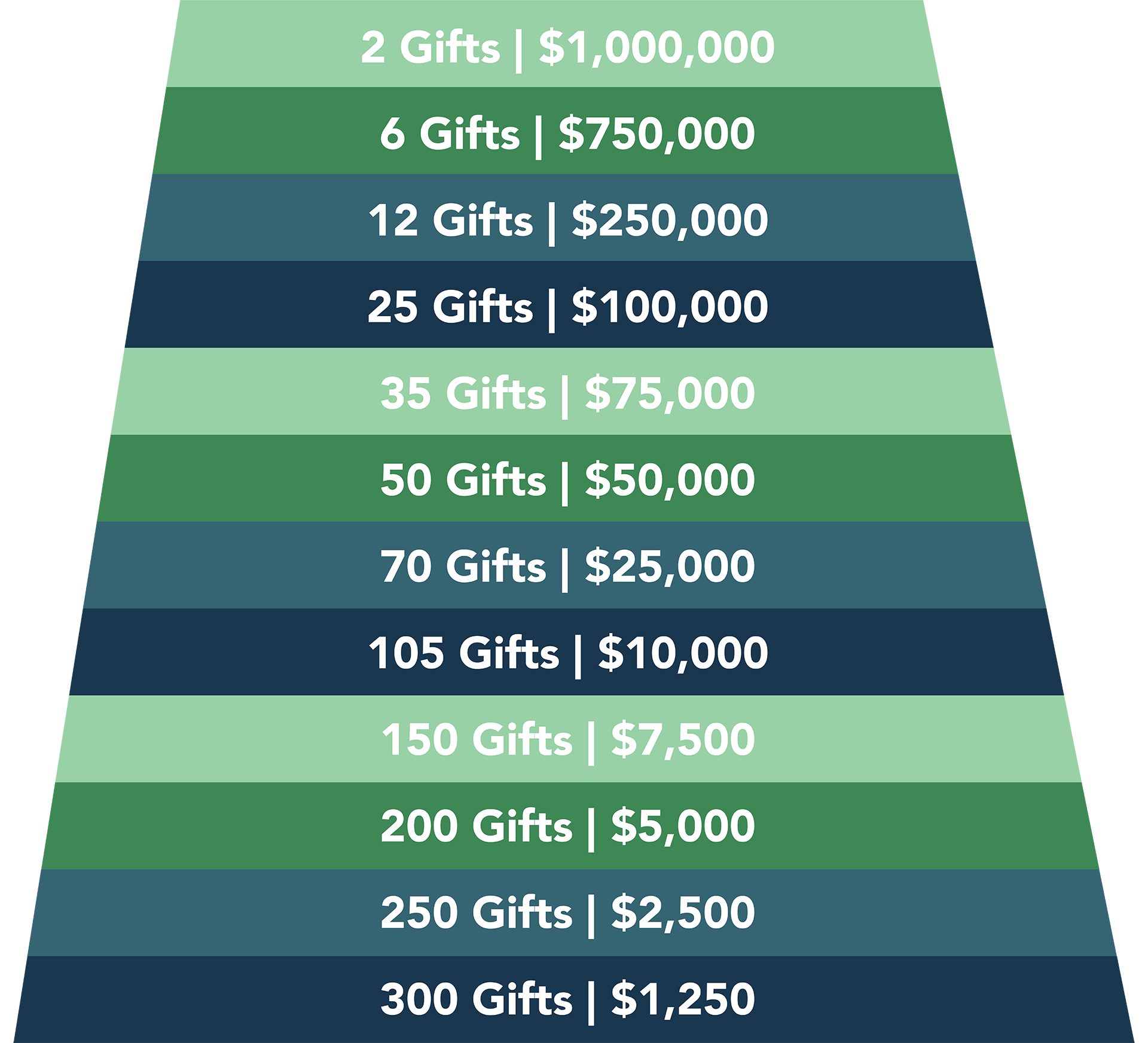

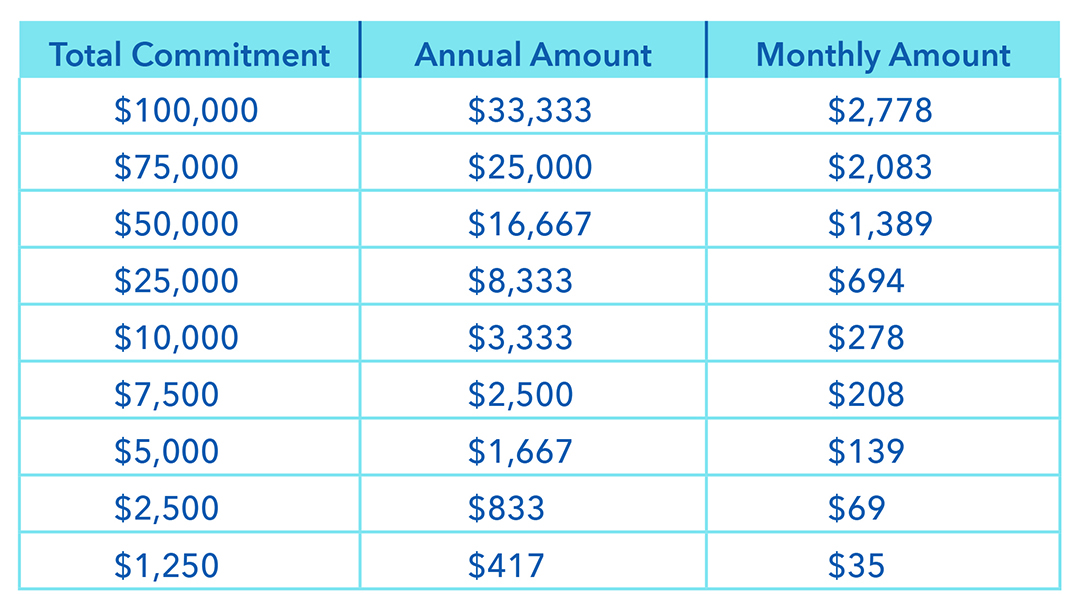

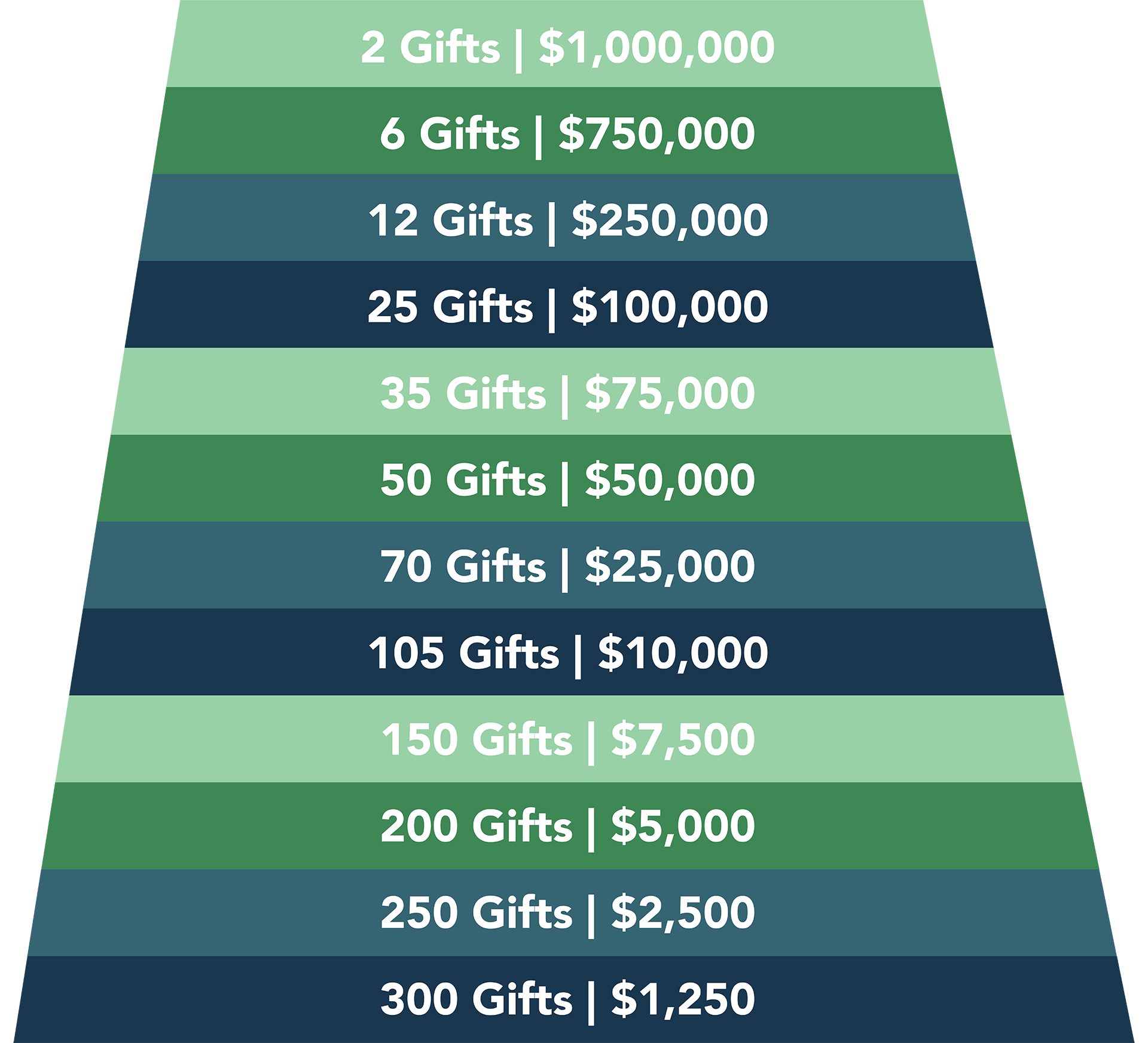

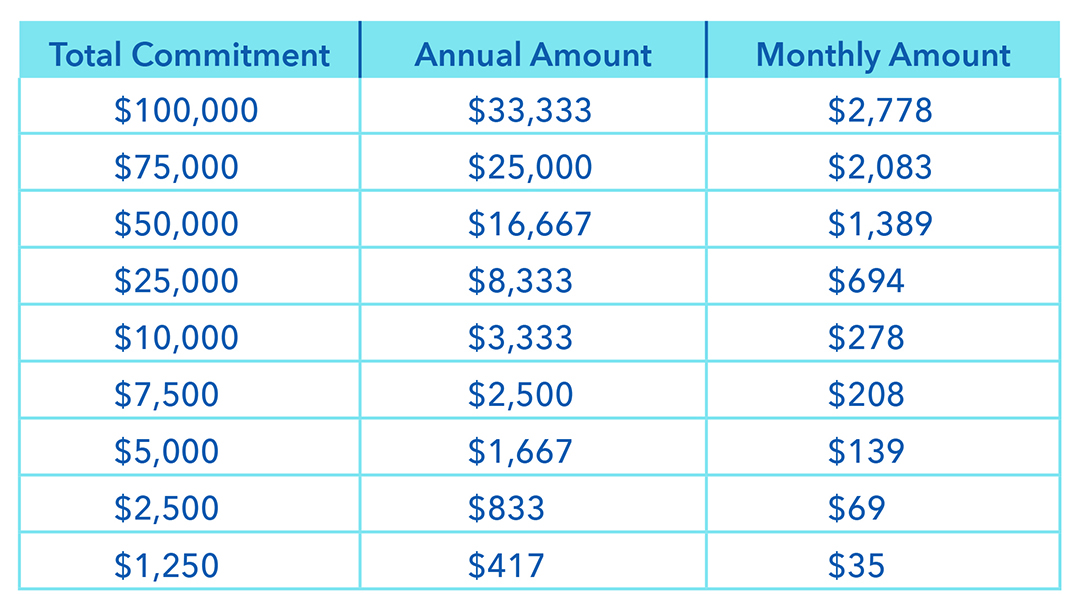

How We Get There

These TRANSFORMED 3-year comittments are over and above your annual generosity giving to the ministries of St. Luke’s.

Ways to Give

Pledging We’re so glad you’re thoughtfully considering your financial commitment to this campaign. We ask that you experience all of the sermons and join the congregation for the six-day prayer journal starting May 17 here come and back to pledge either on this site or by pledge card after May 22. Look for your pledge card in the mail the week of May 10. Commitment Sunday is on Pentecost, May 23, either in church, online or by drive-through.

In-Person In addition to donating in person during worship services you can give in the following ways:

Online Visit this page after May 22 pledge online.

Check or Donor Advised Fund Checks can be made payable to St. Luke’s UMC with “Transformed” in the memo line and can be mailed to:

St. Luke’s UMC, Attn: Finance Office

PO Box 22013, Houston, TX 77227-2013

Text to Give Text TRANSFORMED [gift amount] to 832-669-5500 to donate one time or set up a recurring gift. For example: TRANSFORMED 100. You also have the option of contributing to cover fees associated with electronic giving.

IRA Distributions Required distributions can be directed to fulfill your capital campaign commitment.

Stock Gifts This can be a very beneficial way to give a gift without paying capital gains taxes on the appreciation or the gain over your original cost.

Employer Matching Many employers have matching gift programs to eligible charitable programs. Please contact your Human Resources representative directly to inquire matching program requirements. St. Luke’s will fill out required paperwork as necessary.

For stock transfer instructions, Tax ID number, or any additional questions, please contact the Finance Office at 713-402-5026 or transformed@stlukesmethodist.org.

The Federal CARES Act For those who itemize, 2021 gifts of cash to St. Luke’s are deductible to 100% of adjusted gross income, up from the usual limit of 60%, under terms of the federal CARES Act adopted in 2020. For those who do not itemize, 2021 gifts of cash to St. Luke’s are deductible, in addition to the standard deduction, in amounts up to $300 for single taxpayers and up to $600 for married couples filing jointly.

Note: Always consult your tax advisor concerning the application of tax laws to your particular situation.

Transformed Projects

Now, it seems not only feasible, but necessary, to call on your sacrificial giving in response to God’s grace. The capital campaign, with its life-changing elements, gives all of us working together the opportunity to be the hands and feet of Jesus in our community, especially for those who have been not so fortunate.

Capital Campaign Goal

P1 – Support Small Steps

$1,000,000 | 4%

P2 – Build a Community Center

$15,000,000 | 65%

P3 – Support the PX Project Workforce Development Program

$750,000 | 3%

P4 – Retire Garage Debt

$5,000,000 | 22%

P5 – Build a New Woodshop

$800,000 | 4%

P6 – Restore the Spire, Enhance Westheimer Campus

$500,000 | 2%

How We Get There

These TRANSFORMED 3-year comittments are over and above your annual generosity giving to the ministries of St. Luke’s.

Ways to Give

Pledging We’re so glad you’re thoughtfully considering your financial commitment to this campaign. We ask that you experience all of the sermons and join the congregation for the six-day prayer journal starting May 17 here come and back to pledge either on this site or by pledge card after May 22. Look for your pledge card in the mail the week of May 10. Commitment Sunday is on Pentecost, May 23, either in church, online or by drive-through.

In-Person In addition to donating in person during worship services you can give in the following ways:

Online Visit StLukesTransformed.org to gift using a credit card or bank account draft to recur monthly or one-time.

Check or Donor Advised Fund Checks can be made payable to St. Luke’s UMC with “Transformed” in the memo line and can be mailed to:

St. Luke’s UMC, Attn: Finance Office

PO Box 22013, Houston, TX 77227-2013

Text to Give Text TRANSFORMED [gift amount] to 832-669-5500 to donate one time or set up a recurring gift. For example: TRANSFORMED 100. You also have the option of contributing to cover fees associated with electronic giving.

IRA Distributions Required distributions can be directed to fulfill your capital campaign commitment.

Stock Gifts This can be a very beneficial way to give a gift without paying capital gains taxes on the appreciation or the gain over your original cost.

Employer Matching Many employers have matching gift programs to eligible charitable programs. Please contact your Human Resources representative directly to inquire matching program requirements. St. Luke’s will fill out required paperwork as necessary.

For stock transfer instructions, Tax ID number, or any additional questions, please contact the Finance Office at 713-402-5026 or transformed@stlukesmethodist.org.

The Federal CARES Act For those who itemize, 2021 gifts of cash to St. Luke’s are deductible to 100% of adjusted gross income, up from the usual limit of 60%, under terms of the federal CARES Act adopted in 2020. For those who do not itemize, 2021 gifts of cash to St. Luke’s are deductible, in addition to the standard deduction, in amounts up to $300 for single taxpayers and up to $600 for married couples filing jointly.

Note: Always consult your tax advisor concerning the application of tax laws to your particular situation.

Transformed Projects

Now, it seems not only feasible, but necessary, to call on your sacrificial giving in response to God’s grace. The capital campaign, with its life-changing elements, gives all of us working together the opportunity to be the hands and feet of Jesus in our community, especially for those who have been not so fortunate.

Capital Campaign Goal

P1 – Support Small Steps

$1,000,000 | 4%

P2 – Build a Community Center

$15,000,000 | 65%

P3 – Support the PX Project Workforce Development Program

$750,000 | 3%

P4 – Retire Garage Debt

$5,000,000 | 22%

P5 – Build a New Woodshop

$800,000 | 4%

P6 – Restore the Spire, Enhance Westheimer Campus

$500,000 | 2%

How We Get There

These TRANSFORMED 3-year comittments are over and above your annual generosity giving to the ministries of St. Luke’s.

Ways to Give

Pledging We’re so glad you’re thoughtfully considering your financial commitment to this campaign. We ask that you experience all of the sermons and join the congregation for the six-day prayer journal starting May 17 here come and back to pledge either on this site or by pledge card after May 22. Look for your pledge card in the mail the week of May 10. Commitment Sunday is on Pentecost, May 23, either in church, online or by drive-through.

In-Person In addition to donating in person during worship services you can give in the following ways:

Online Visit StLukesTransformed.org to gift using a credit card or bank account draft to recur monthly or one-time.

Check or Donor Advised Fund Checks can be made payable to St. Luke’s UMC with “Transformed” in the memo line and can be mailed to:

St. Luke’s UMC, Attn: Finance Office

PO Box 22013, Houston, TX 77227-2013

Text to Give Text TRANSFORMED [gift amount] to 832-669-5500 to donate one time or set up a recurring gift. For example: TRANSFORMED 100. You also have the option of contributing to cover fees associated with electronic giving.

IRA Distributions Required distributions can be directed to fulfill your capital campaign commitment.

Stock Gifts This can be a very beneficial way to give a gift without paying capital gains taxes on the appreciation or the gain over your original cost.

Employer Matching Many employers have matching gift programs to eligible charitable programs. Please contact your Human Resources representative directly to inquire matching program requirements. St. Luke’s will fill out required paperwork as necessary.

For stock transfer instructions, Tax ID number, or any additional questions, please contact the Finance Office at 713-402-5026 or transformed@stlukesmethodist.org.

The Federal CARES Act For those who itemize, 2021 gifts of cash to St. Luke’s are deductible to 100% of adjusted gross income, up from the usual limit of 60%, under terms of the federal CARES Act adopted in 2020. For those who do not itemize, 2021 gifts of cash to St. Luke’s are deductible, in addition to the standard deduction, in amounts up to $300 for single taxpayers and up to $600 for married couples filing jointly.

Note: Always consult your tax advisor concerning the application of tax laws to your particular situation.